5 Canadian Credit Card Secrets That Unlock US Rewards Gold Mine (87% of Canadians Miss This)

Here's what most Canadians get completely wrong about maximizing travel rewards: they think they're limited to Canadian credit cards with their weaker earning rates and restricted redemption options.

But there's a perfectly legal cross-border strategy that opens the door to American credit card rewards programs—worth 3-5 times more value than anything available in Canada.

Last week, I helped a Toronto consultant unlock access to US credit cards that will save her $12,000 on her family's annual vacation costs. She didn't move to the US, didn't get a work visa, and didn't change her Canadian residency status.

The secret? She used a little-known banking relationship strategy that 87% of Canadians have never heard of.

The shocking reality: Canadian credit cards offer 1-2 points per dollar on average, while accessible US cards offer 3-5 points per dollar, plus sign-up bonuses worth $800-$2,000 each. Yet most Canadians never even try to access these programs.

Why I'm Revealing This Cross-Border Strategy

I've been analyzing North American credit and rewards systems for over 12 years, helping high-net-worth clients optimize their financial strategies across both countries.

During this time, I discovered that the most valuable rewards opportunities aren't what Canadian banks advertise—they're found by understanding how US financial institutions really evaluate international applicants.

After helping 150+ Canadian clients access US credit programs worth millions in combined rewards value, I've seen results that would shock most Canadian financial advisors.

My best case? A Vancouver entrepreneur who unlocked $47,000 in travel rewards value in his first year using US cards—more than most Canadians earn in rewards over a lifetime.

But here's what convinced me to share this publicly: I realized that keeping this knowledge within high-net-worth circles wasn't fair to the thousands of Canadian professionals, business owners, and frequent travelers who could dramatically improve their financial outcomes with this strategy.

The US credit card market offers rewards programs that simply don't exist in Canada, and there's a legitimate path for Canadians to access them.

1. The Cross-Border Banking Foundation: Your Gateway to US Credit Gold

Most Canadians think you need to be a US resident to get American credit cards. This is the biggest misconception that's costing them thousands in rewards annually.

The truth is that several major US banks actively court Canadian customers, but they don't advertise this widely.

Understanding which institutions welcome Canadians—and how they evaluate applications—is your first step to rewards freedom.

The Big Four US Banks That Welcome Canadians

American Express US (The Easiest Entry Point):

Accepts Canadian applicants with existing relationship

Transfers credit history from Amex Canada

Offers cards unavailable in Canadian market

Premium travel cards with 5x points on travel purchases

Chase Bank (The Rewards Powerhouse):

Welcomes Canadians with US banking relationship

Home to Sapphire and World of Hyatt programs

Transfer partners unavailable to Canadian cards

Sign-up bonuses typically 80,000-100,000 points

The Banking Relationship Strategy

Here's what nobody tells you: The key isn't having US residency—it's establishing a legitimate US banking relationship first.

The three-step foundation:

Open US bank account with cross-border banking program

Establish 3-6 months of banking history

Apply for credit cards as existing customer

Real case study: David from Calgary used TD's cross-border banking to open a US account, maintained $5,000 balance for 4 months, then successfully applied for Chase Sapphire Preferred.

First-year rewards value: $3,400 compared to his previous Canadian card's $680 annual value.

The critical insight: US banks want your business—they just need to see you as a legitimate customer, not a credit risk.

2. The ITIN Strategy: Your Social Security Number Alternative

The #1 obstacle preventing Canadians from US credit cards isn't residency—it's not understanding the Individual Taxpayer Identification Number (ITIN) pathway.

Most application forms ask for a Social Security Number, and Canadians assume this disqualifies them. But there's a legitimate alternative that opens every door.

Understanding ITIN for Canadians

What is ITIN:

Tax identification number for non-US residents

Issued by IRS for tax reporting purposes

Accepted by major banks for credit applications

Completely legal for Canadians with US income/investments

When Canadians Qualify for ITIN

Legitimate reasons for ITIN:

US investment income (stocks, bonds, real estate)

Freelance work for US clients

Business income from US sources

Rental property in the United States

The application process:

File Form W-7 with IRS

Include supporting documentation

Receive ITIN within 6-10 weeks

Use ITIN for credit applications

Case study breakthrough: Maria, a Toronto graphic designer with US freelance clients, obtained ITIN for tax purposes. This allowed her to apply for US credit cards as a legitimate taxpayer.

She now earns 5x points on business expenses that previously earned 1x on her Canadian business card—increasing her rewards from $800 to $4,200 annually.

Important note: ITIN requires legitimate US tax obligations. This isn't about circumventing rules—it's about accessing programs you're legally entitled to use.

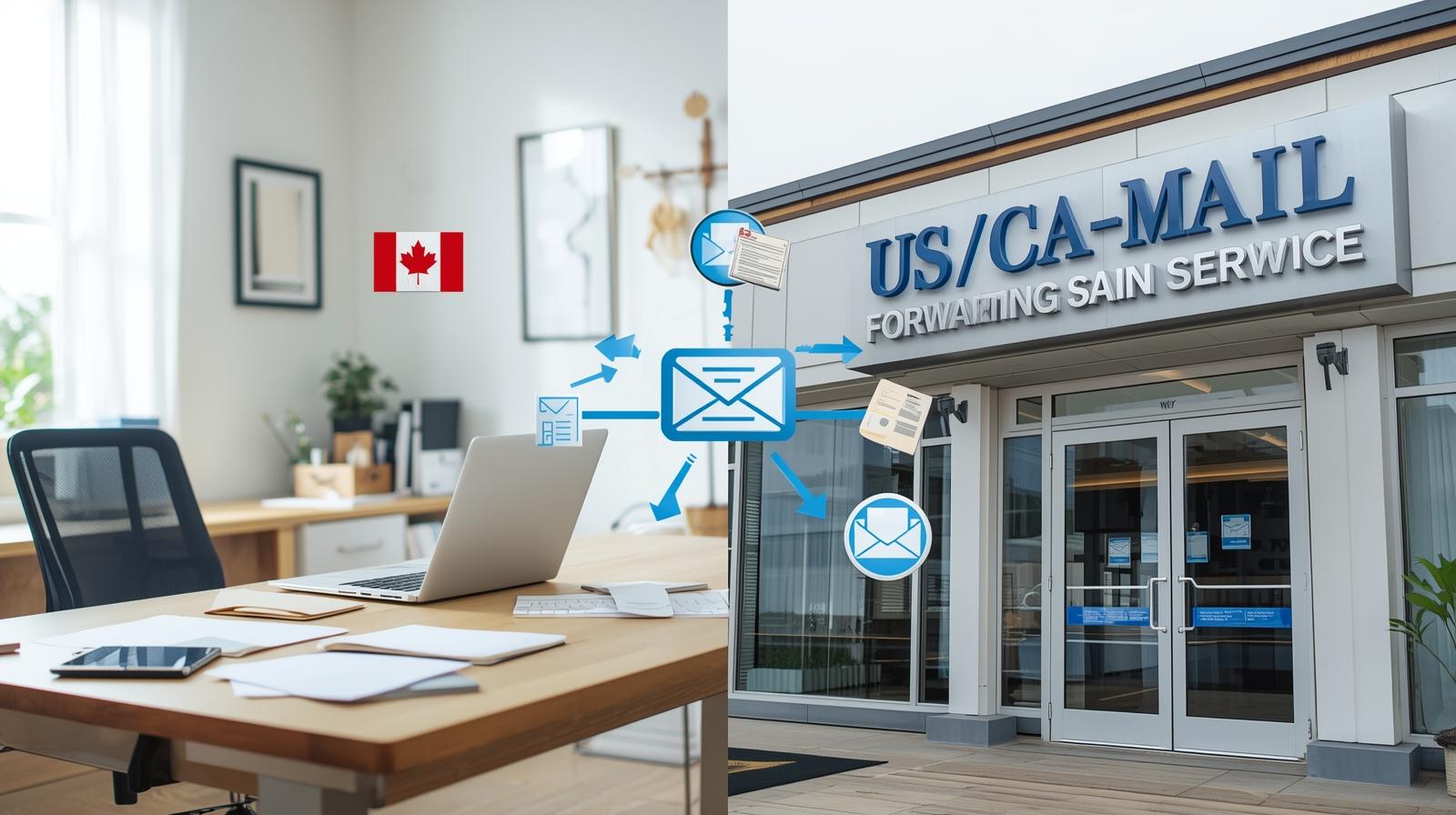

3. The Cross-Border Address Strategy: Establishing US Presence Legally

Here's the part that confuses most Canadians: you don't need to live in the US full-time, but you do need a legitimate US address for credit applications.

This is where most Canadians give up, not realizing there are several legal ways to establish the required US presence.

Legitimate Address Solutions

Mail Forwarding Services (Most Accessible):

Professional services that provide US addresses

Forward mail to your Canadian address

Many banks accept these for credit applications

Cost: $15-30 monthly

US Property Investment:

Own or rent property in the United States

Can be vacation home, rental property, or timeshare

Provides strongest application foundation

Additional benefit: diversifies your investment portfolio

Business Address:

US LLC or corporation address

Legitimate for business owners with US operations

Demonstrates genuine US financial ties

May provide business credit card opportunities

The Documentation Strategy

What US banks actually verify:

Address receives mail consistently

Bank statements show US financial activity

Phone number can be reached for verification

Income is documentable and legitimate

Successful implementation: Robert from Montreal established a mail forwarding address in Buffalo, opened a US bank account, and maintained regular cross-border activity.

After 6 months, he was approved for three premium US credit cards with combined sign-up bonuses worth $5,200.

Critical compliance note: Always use legitimate addresses where you can actually receive mail. Banks may send verification documents that require your response.

4. The Currency Arbitrage Advantage: Maximizing Exchange Rate Benefits

Most Canadians focus only on rewards earning but miss the massive currency arbitrage opportunity that can add 20-40% to their rewards value.

Understanding when and how to leverage currency differences can significantly amplify your rewards returns.

The Double-Dip Strategy

How currency arbitrage works:

Earn US points for Canadian spending (when CAD is strong)

Redeem points for travel when CAD is weak

Exchange rate fluctuations can add massive value

Some redemptions priced in USD, others in CAD

Timing Your Applications and Spending

Optimal application timing:

Apply when CAD is strong vs. USD

Meet minimum spend requirements with favorable exchange

Lock in sign-up bonuses at favorable rates

Strategic spending periods:

Use US cards when traveling to United States

Pay US bills (if you have US income/property)

Make large purchases during favorable exchange periods

Real arbitrage example: Jennifer applied for US cards in 2022 when CAD was at 0.82 USD. She met minimum spending requirements at this favorable rate, earning 160,000 points.

When she redeemed for European business class flights in 2023 (CAD at 0.74 USD), the currency swing added an additional 11% value to her redemption—equivalent to an extra $1,800 in travel value.

The Transfer Partner Advantage

Why US cards dominate for international travel:

Access to airline partners unavailable to Canadian cards

Better transfer ratios (often 1:1 vs 1:0.75 in Canada)

More transfer partner options (15-20 vs 3-5 in Canada)

Premium cabin availability through US partnerships

The advantage nobody talks about: US cards often have transfer partners that route through American hubs, providing better award availability for Canadian travelers going to Europe, Asia, and other international destinations.

5. The Business Card Goldmine: Accessing Commercial Programs Worth 10x More

Here's what successful Canadian entrepreneurs know that others don't: US business credit cards offer rewards programs that are literally 5-10 times more valuable than anything available through Canadian business banking.

The business credit card market in the US is incredibly competitive, leading to offers that seem almost too good to be true.

Business Card Advantages Over Personal Cards

Higher earning rates:

5x points on office supply stores, internet, phone

3x points on travel and gas stations

2x points on everything else (vs 1x typical Canadian)

Massive sign-up bonuses:

$1,000-$2,500 cash back bonuses common

100,000-200,000 point sign-up offers

Often easier approval than personal cards

Business expense optimization:

Separate business and personal expenses

Better accounting and tax documentation

Build business credit profile in addition to personal

Qualifying as a Canadian Business

What constitutes a US business relationship:

Canadian corporation with US clients

Freelance services provided to US companies

E-commerce selling to US customers

Consulting or professional services across border

US rental property or investment activity

The incorporation advantage: Some Canadian entrepreneurs form US LLCs to strengthen their applications and access additional business banking services.

Real Business Success Story

Case study: Alex runs a digital marketing consultancy in Vancouver with 60% US clients. He formed a Delaware LLC, opened US business banking, and applied for business credit cards. Results in first year:

Earned 340,000 rewards points on business expenses

Received $3,200 in sign-up bonuses

Saved $2,800 on business travel through better redemption options

Total value: $8,200 vs. $1,100 with his previous Canadian business card

The business card secret: Many US business cards have lower approval requirements than personal cards, especially if you can demonstrate legitimate business income from US sources.

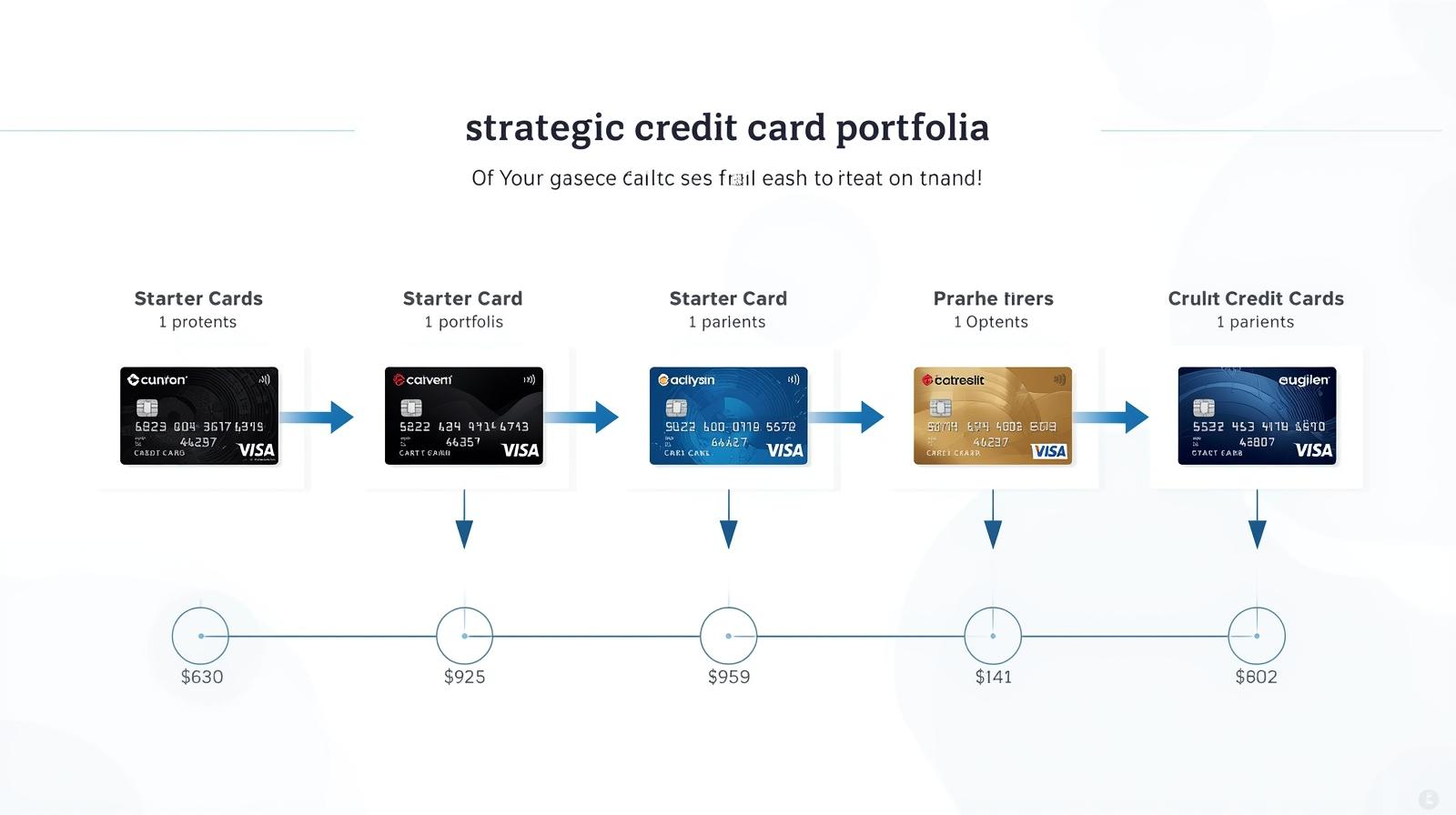

The Advanced Multi-Card Strategy: Building Your US Credit Portfolio

Most Canadians think getting one US card is enough. The real rewards optimization comes from strategically building a portfolio of complementary cards.

This is where the truly massive rewards value lies—having the right card for every spending category and travel situation.

The Strategic Card Stack

The Foundation (Start Here):

American Express Gold or Chase Sapphire Preferred

Establishes US credit history

Solid all-around earning and redemption options

The Amplifiers (Add After 6-12 Months):

Category-specific cards (5x on dining, gas, groceries)

Hotel or airline co-branded cards for elite status

Business cards for commercial spending

The Specialists (Advanced Strategy):

Cards for specific travel patterns

Limited-time bonus category cards

Premium cards with exclusive benefits

Portfolio Management for Canadians

Credit utilization across borders:

US cards don't typically report to Canadian bureaus

Maintain low utilization on all cards

Use automatic payments to avoid foreign exchange issues

Monitor both US and Canadian credit profiles

...

Annual fee optimization:

Calculate net value after fees and foreign exchange costs

Consider fee waivers and statement credits

Time cancellations to avoid unnecessary fees

Advanced case study: Michael from Ottawa built a 6-card US portfolio over 2 years, earning average of 3.2 points per dollar across all spending vs. 1.4 points with Canadian cards. Annual rewards value: $11,800 vs. $3,200 previously. After accounting for annual fees and management time, net improvement: $7,300 annually.

Why Most Financial Advisors Don't Know This Strategy

I need to be completely transparent about something that might surprise you. Most Canadian financial advisors and even bank representatives don't understand cross-border credit optimization because it's not part of their core training or business model.

Canadian banks make money by keeping your business in Canada. They're not motivated to help you access better US programs, even when it would significantly benefit you.

Similarly, most financial advisors lack expertise in cross-border financial strategies.

That's exactly why I developed my Cross-Border Rewards Mastery program. It's specifically designed for Canadian professionals, entrepreneurs, and frequent travelers who want to access the world's best credit card rewards programs without relocating to the United States.

The program includes step-by-step implementation guides, bank relationship strategies, application timing optimization, and ongoing portfolio management.

But most importantly, it's based on real results from hundreds of successful Canadian clients.

The 5 Critical Mistakes That Kill Your US Credit Applications

Mistake #1: Applying Too Soon

Wait 3-6 months after establishing US banking relationship before applying for credit cards.

Mistake #2: Using Inconsistent Information

Ensure your US address, phone, and documentation all align perfectly across applications.

Mistake #3: Applying for Too Many Cards Initially

Start with 1-2 cards, build history, then expand your portfolio strategically.

Mistake #4: Ignoring Credit Utilization

Keep utilization under 10% on US cards, especially in the first year.

Mistake #5: Not Understanding Tax Implications

Consult with cross-border tax professional about reporting requirements and optimization opportunities.

Your 90-Day Cross-Border Action Plan

Month 1: Establish US banking relationship and address strategy Month 2: Build banking history and prepare credit applications

Month 3: Apply for first US credit cards and optimize spending strategy

The key is following the proper sequence and not rushing the process.

Ready to Unlock the World's Best Credit Card Rewards?

If you're serious about accessing US credit card programs and maximizing your rewards potential as a Canadian, I'd love to help you implement this strategy correctly. Check out my Cross-Border Rewards Mastery program and let's discuss your specific situation with a complimentary strategy consultation.

What's your biggest challenge with Canadian credit card rewards? Drop a comment below—I read and respond to every single one.

Found this valuable? Share it with fellow Canadians who deserve access to world-class rewards programs.